I own 18 ETF Securities Physical Gold ETF shares with the (

PHAU) ticker on the London Stock Exchange. Each of these shares entitles me to 0.0982449 of an ounce of gold (according to this page on ETF Securities web site:

http://www.etfsecurities.com/msl/index.asp).

Why have I got this much gold per share? According to the

PHAU prospectus it's because everyday that the share exists a small chunk of it is paid back to ETF Securities. Over a year these small chunks will equal the 0.39% annual management fee.

The amount of gold per share diminishes every day from the date of the launch which means the older the ETF the less gold each of its shares will be entitled to. When PHAU shares were launched in 2007 they were entitled to 0.1 of an ounce of gold and that has been diminishing ever since. Hence the 0.0982449 of an ounce of gold per share today.

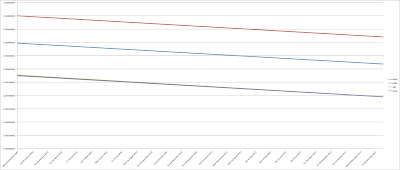

The chart below shows the rate of decay for three physical gold ETFs from November 2009. I picked this date because it was the launch of the ETFS Physical Swiss Gold (

SGBS). At launch SGBS shares were entitled to 0.1 fine troy ounce of gold each.

The US dollar version (PHAU) which I own was launched in April 2007 so is entitled to less gold than the Swiss ETF.

Meanwhile Gold Bullion Securities (

GBS) is even older having started in 2003. It also pays a higher management fee of 0.4%. However it allows investors to convert their shares into physical gold (which means different rules apply to it - it can't be held in an ISA and the annual management fee is slightly higher (

question number 28)).

Even though I am never likely to touch the gold I own, it determines the value of the shares. So the value of PHAU shares diminish inline with the amount of physical gold backing it.

In

a 2009 article by Index Universe Ronan O'Shea of market-making firm Nyenburgh, said: "Most of the time the different physical gold trackers have traded in line with the asset value implied by their gold content, with occasional premiums to NAV, which have occurred more often for those funds with a less-diversified creation and redemption mechanism (where ETFs have fewer official market makers - known as 'authorised participants' - who have to offer a price at which they will buy ETF shares from investors and price at which they will sell to them).

What is that gold worth today?

So, if I own 1.7684082 ounces of gold, what do I actually get when I sell it?

At 4.30pm today, when the London Stock Exchange shut up shop, my broker, Hargreaves Lansdown was offering to buy my shares for $176.40 each. If each share is entitled to 0.0982449 of an ounce of gold then they would be paying me $1,795.5 per ounce (176.4/0.0982449).

That's before working out what the pound dollar conversion rate would be or taking into account the £11.95 cost of selling.

But first I want to check that I am actually getting a reasonable deal on the gold spot price. According to

BullionVault's spot price chart the selling price of gold was pretty close to $1,795 at 4.30pm.

It looks like I've done better than I should have done!

But what have I got in pounds? If I take my 1.7684082 ounces of gold and multiply it by the value of $1,795.5 per ounce it comes out at $3,175.20 for the whole lot. When I wrote this story the pound was buying $1.60 (

Google Chart) and so my investment would be worth £1,984 in total.

Does this correspond with the pound denominated version of this ETF? The value of the PHGP exchange traded fund was £109.65 to sell. I have 18 shares, this would have come to £1,973, so I'm out by a bit - it could be the exchange rate (I don't know which one they're using, or just straight maths failure).

I can also check the value of my holding in the Hargreaves Lansdown account which is based on the bid price and on a $1.6072 exchange rate. That comes out a lot closer to the PHGP value (not surprisingly!) at £1,975.61

If I took my gold to a pawnshop in Hackney, what would I get?

All together, in ounces my shares hold 1.7684082 oz(troy) which converts into 55.0036 g.

If I wanted to sell my gold in a Hackney pawnshop I'd got to one called Cashier (

last month they offered me the best deal) and today their selling price was £25 per gram which would have got me just £1,375 for all my gold. Bear in mind that they only offer it on 22

carat gold and the gold I own is 24 carat.