There was another one last week: why do I invest in a fund rather than an ETF when it comes to gold mining companies? I only asked myself this question after seeing a piece on gold miner ETFs in Moneyweek - the inconsistency hadn't occurred to me before!

(The ETFs discussed in Moneyweek were iShares SPGP, ETF Exchange's AUCO ($), AUCP (£) and RBS's GOLB - the last of these were synthetic/swap-based and all of them track indices. An investor like me has to know such things as whether the mining firms in the index hedge their gold - in which case they won't benefit so much from a rise in gold price. So, one reason why I don't fancy the gold miner ETFs at the moment is that a certain amount of knowledge is needed about the construction of an index, the construction of the product, the industry, the way companies operate that I do not have. That, though, is a retrospectively applied reason.)

I think that actual reason I haven't invested in them is simpler:

I invest in the Black Rock Gold and General fund because I can make a number of small investments that cost -as far as I can tell - 'nothing'. There are higher management charges but they appear to be less that what it would cost to make these small investments into an ETF. There are disadvantages in funds too, a big one being that I can only buy and sell once a day and at an unknown price.

Since I started this blog I have invested in the BlackRock fund seven times.

The first investment was £1000 on 23 September 2011 when the unit price was 1,608p and then in lots of £250 at irregular dates after that:

24/11/2011 - unit price 1,503p

24/11/2011 - unit price 1,503p25/11/2011 - unit price 1,484p

23/12/2011 - unit price 1,441p

21/03/2012 - unit price 1,438p

05/04/2012 - unit price 1,318p

11/05/2012 - unit price 1,200p

The total investment in the fund is now £2,500 and it would have cost me nearly £80 to have done this using ETFs. But this low cost has led me to owning more than I meant to. I have generally bought units when I couldn't make my mind up about spending £11.95 buying more physical gold ETF shares.

The investment was down 12.5% while the ETFs were level, although there's a bad history not shown there!

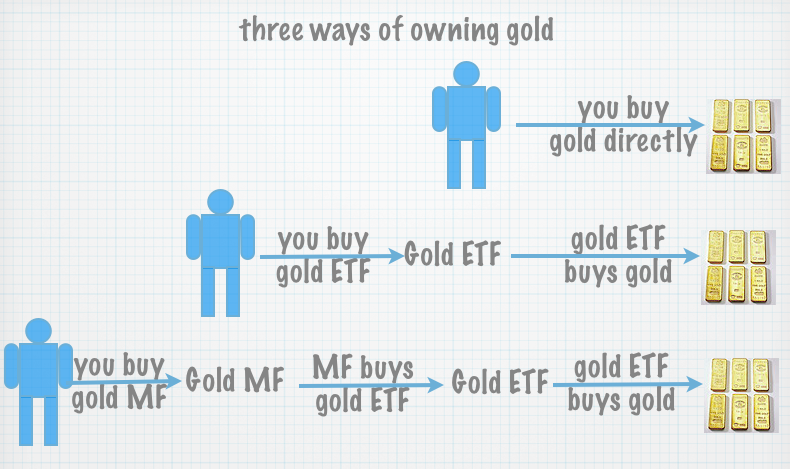

I got the pic below from OneMint which provided an interesting review of an indian gold mutual fund called SBI Gold Fund.

Thanks for this informative posting. It is a great question for investors where they should invest? You can take the help of Selective Financial Services for fund investment. They have expertize in marketing cycles and associated with finance institutes.

ReplyDeletePermit me to introduce you to LE-MERIDIAN FUNDING SERVICES. We are directly into pure loan and project(s) financing in terms of investment. We provide financing solutions to private/companies seeking access to funds in the capital markets i.e. oil and gas, real estate, renewable energy, Pharmaceuticals, Health Care, transportation, construction, hotels and etc. We can finance up to the amount of $900,000,000.000 (Nine Hundred Million Dollars) in any region of the world as long as our 1.9% ROI can be guaranteed on the projects.

ReplyDeleteLe-Meridian Funding Service.

(60 Piccadilly, Mayfair, London W1J 0BH, UK) Email Contact Info...lfdsloans@lemeridianfds.com

The Le_Meridian Funding Service went above and beyond their requirements to assist me with my loan which i used expand my pharmacy business,They were friendly, professional, and absolute gems to work with.I will recommend anyone looking for loan to contact. Email..lfdsloans@lemeridianfds.com Or lfdsloans@outlook.com.WhatsApp ... + 19893943740.

ReplyDelete